Substack Library

GlossaryAI, the Other and Japan

May 25, 2024“In modern times, much of the real business of empire has moved underground. American imperium still uses military power to keep surface trade routes open, deploying the US Navy to patrol global sea-lanes. But American power also travels along buried fiber-optic cables, insulating itself into networks like the internet and the complex financial infrastructures used by banks to send money around the world.”

Underground Empire, Newman and Farrell, 2023

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Today’s key points:

-

We are in a two-speed economy—AI and everything not connected to AI.

-

The rise in AI may impact central bank policy, not necessarily for good reasons.

-

Japan is the one place with clearly too easy monetary policy. That has begun to change and may change fast.

More below:

Like the Singapore Airlines plane that experienced sudden volatility, there are odd things going on in financial markets. The plane evidently hit an area of notorious turbulence, the Bay of Bengal, injuring many and forcing an emergency landing. We are also in such an area of turbulence, a tech euphoria following a crisis, the pandemic. This reminds me of 1998/1999, after the Asian economic crisis and heading into a tech stock bubble, with a few notable differences, profits in particular.

I remember that late 90s period vividly even if, at the time, I understood little of what was going on. I was working on a bank trading floor. The area I worked in specialized in foreign exchange and bonds, not stocks. Yet, people on the trading desk would pass around stock symbols like they were tickets to a rocket launch. If you just punched in the right letters on the screen money appeared.

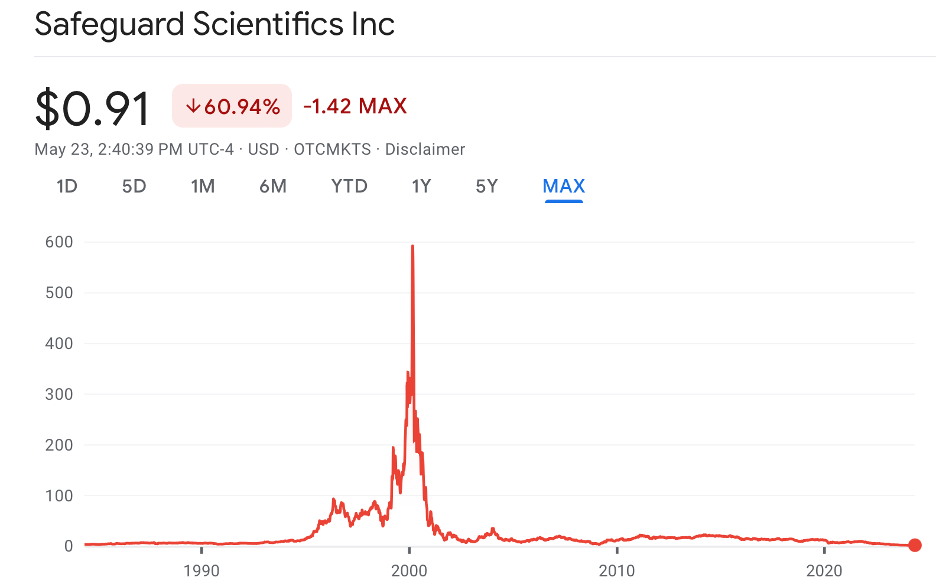

The guy sitting next to me was a fan of the company Safeguard Scientifics. He’d put a big chunk of his savings in the stock. I watched. I had no idea what Safeguard did and I suspect he didn’t either. He wasn’t exactly pouring over financial statements or interrogating management. As I recall, he was buying somewhere in the 170s. It would more than double from there…before descending to where it is now, less than $1 a share, a quarter century later.

Earlier this week, a different friend sent me information about an independent energy producer, one of the ones that hasn’t yet jumped 100%. I didn’t have time to dig into it immediately. On Friday, as I did a peripheral scan of who they are and what they do, the stock leapt 7% in minutes. This brought back memories.

The rocket fuel for the late 90s bubble was:

-

genuine, in retrospect justifiable, excitement over new technology that got way out of hand and

-

interest rate cuts tied to a genuine economic crisis, the 1998 Asian financial crisis.

The potential ingredients for this bubble are genuine excitement over technology, so far a lot of profits and expected (discounted) interest rate cuts following the ebbing of a crisis (Covid).

There are two key differences between now and 1999.

-

First, in 1999, the last really big stock market bubble had been 1929. Few remembered what happened. My Dad was a kid in 1929 and he vividly remembered the aftermath, so I knew from his stories that stock market bubbles were bad news. Now memories of a nasty crash are much more recent, leading pockets of investors to be quite worried and holding back from buying stocks. If they start buying, things could shift.

-

Second, the thing to look for is when expectations of earnings rise much faster than the earnings themselves, which, so far, is largely not happening. Nvidia’s PE before the euphoria was in the mid-20s, now it is in the low 30s. A lot of the most egregious fluff came out of the market in 2022 when the Fed cranked up interest rates.

I wonder, however, if the central bank is now wondering what might happen to the stock market if they ease. Typically, central banks don’t pay much attention to financial markets. And that’s appropriate. Their job is controlling inflation, not the stock market. But policy officials are also human, just like us, with the same limited information and murky understanding of the future. The over riding concern for many is to not look stupid. Will they feel they look stupid by cutting rates into an up stock market?

The key analytical questions for US officials now are:

-

how big is the AI boom?

-

how big is the defense-related boom (everything from on-shoring to a big arms spend related to Taiwan)?

-

how weak is the rest of the economy?

All three are going on at once, the question is the magnitude. To me “a” and “b” while a big deal look smaller than “c.” I haven’t done the estimates myself, but the third party estimates for the AI boom are in the hundreds of billions of dollars. That would add maybe 50 bps to growth depending on when the spending occurs. “B” is a function of the defense budget which is growing but not exploding. (The quote at the outset of this piece, by the way, directly relates to the world I described, fictionally, in Master, Minion.) But because “c” is particularly driven by small businesses and much bigger than “a” or “b” I worry the AI boom can obscure weakness elsewhere.

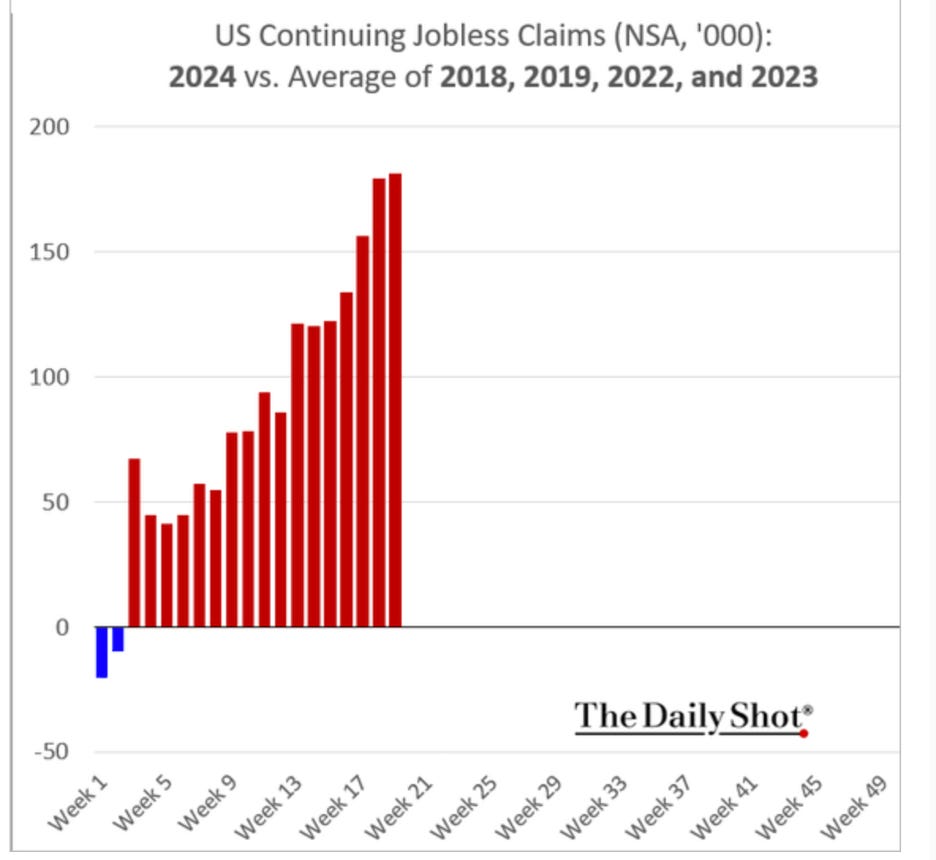

I wrote most of this on a train on my way to a wedding. Riding the Amtrack, the car jerking unpredictably and the internet constantly dropping, it was hard to feel like we are in the epicenter of an AI boom. I also know a number of people who have been fired and can’t find work and there is some softness in the jobs data, as shown below. I believe the data will soften meaningfully in the second half of this year as these trends intensify.

The majority of the economy is not Microsoft or Apple, it is small businesses, which create about 60% of new jobs. These companies, if they need credit, can’t get it at an affordable price, so they are negatively impacted by the Fed’s policy. I suspect that will gradually filter through to the economy and overwhelm the AI shift in terms of inflation.

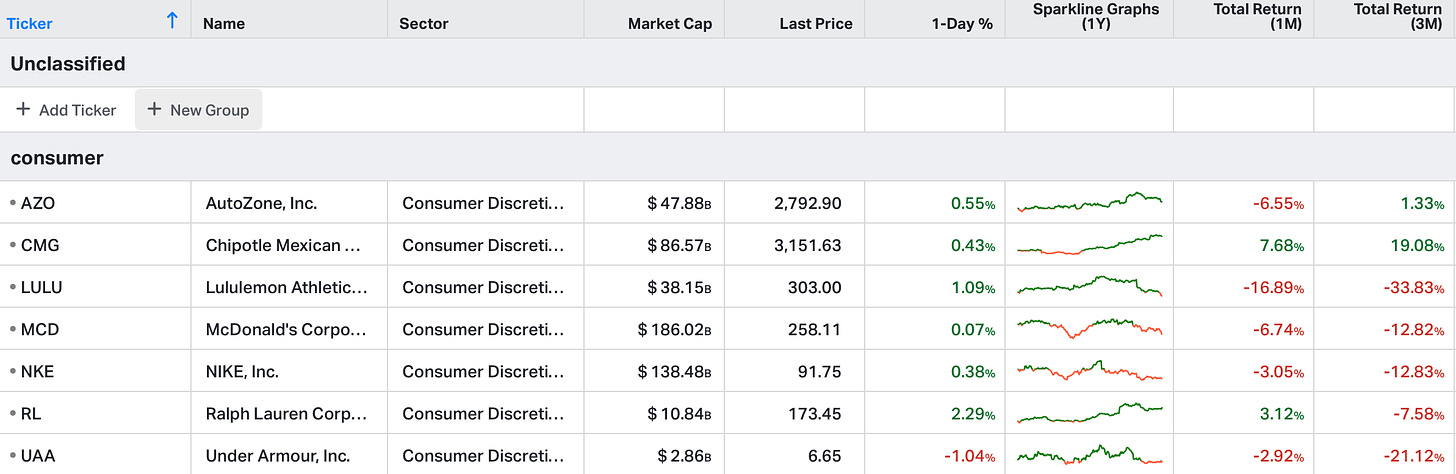

My true north is a 5.3% cash rate with 2.5% inflation = too tight. It is this same logic that makes me negative on Japan. Japanese cash rates are zero, inflation is 2.5% so the real cash rate is -2.5%, which is not sustainable. I then watch the markets and try to read what they are saying. On the one hand, they are agreeing with everything described above. An equally weighted mix of stocks is up 4% this year…the tech stocks are up 12%. Consumer discretionary stocks are generally getting crushed, as shown below.

In my stock portfolio, I’ve been overweight tech and Asia, so that has worked. Japanese bond yields crested 1% this week. I’ve been short.

The part that has surprised me and where I’ve been wrong is on short-term rates. On weak data (CPI in the US and abroad, employment) the bond market rallies, only to sell off again a few days later. Some of this is the challenge of buying bonds with easing already discounted. Inverted yield curves (where long-term bonds yield less than short term bonds) means the market is expecting the Fed, ECB, Bank of Canada to reduce interest rates. So for bonds to go up, they need to reduce interest rates even more than is discounted. I think that’s possible, particularly in Canada and Europe, but the bonds don’t trade that way.