Substack Library

GlossaryReading the Market Action

December 20, 2024THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

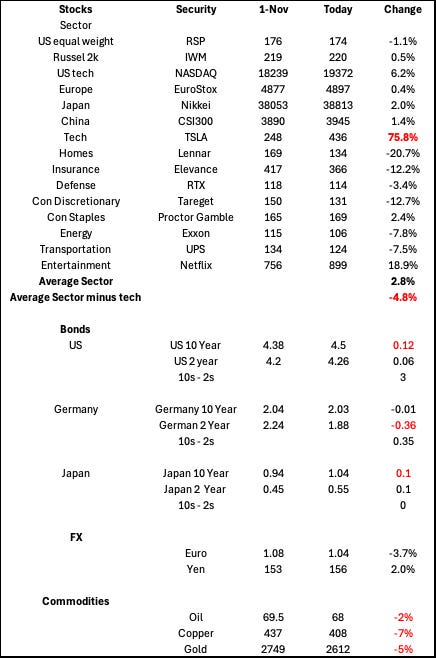

Markets provide objective measures of reality. Kate Capital began managing money for institutions on November 1, so I’m particularly attuned to that time frame. It also happens to be the time just before and after Trump’s election.

The consensus was that Trump would be pro-business and animal spirits. The reality has been that a slice of the stock market, US tech, has gone up, in some cases spectacularly, and the majority has gone down. Bonds have also lost value, as have commodities, including gold, as you can see below, meaning to date the shift has been wealth-destroying. (Higher bond yields = lower prices).

I suspect four forces are interacting at once.

1. AI. The excitement, even euphoria, over AI, robotics, automation, etc. is real and has exploded since it seems like Elon is running not only half a dozen companies but is also a shadow President with the power to knock down a budget. He is a figure of such immense influence it is hard to get one’s mind around it. Tesla is up 75% in 7 weeks. He took a gigantic bet on Trump and won.

2. The Fed. The central bank, the Fed, is either mistaking the strength in the tech stocks for the strength in conditions overall or sending a warning shot about tariffs to Trump, maybe both. While Tesla and the 100 stocks in the NASDAQ are higher, the overall market is, as I said, lower. Weakness in certain sectors, like housing and consumer discretionary, is pronounced.

I listened to Powell’s press conference Wednesday with great attention. The salient quote: “The labor market is looser than pre-pandemic and cooling further. …We don’t think we need further cooling. Job creation is well below the level that would hold unemployment constant. Job finding rate is low and declining.”

The quote and the market action in recent weeks suggest an economy—outside of AI–that is slowing. It is all happening slowly because debt rolls over slowly, but for many companies that are rolling over debt into higher rates they are in a world of hurt. Given what Powell believes about the labor market, deciding to stop cutting interest rates makes more sense if the Fed is worried tariffs will boost inflation. So the Fed’s decision sets up a confrontation. If you (Trump) introduce tariffs, we (the Fed) won’t cut and could even hike, crushing the stock market.

3. China. The US is only part of the story. China is the second biggest economy in the world and is in a massive deflationary bust. This is probably what is hitting commodities. Without going into all the details, the short story is the following. China’s GDP is $18 T. Bad debt from a real estate bust is likely as big as $8T, 40% of GDP. This is roughly twice as bad as the US in 2008. China’s stimulus is about $400B a year, nowhere near large enough and both household and corporate income are contracting. This is a massive deflationary force, falling income against huge obligations and in the background I suspect will tug down global inflation.

4. Internal conflict. Lastly, Trump is pushing on institutions. His role in rejecting the budget is one obvious example. But there are others. For instance, in his press conference this week, he said he was going to “straighten out” the press. On the one hand, this is nothing new. Nixon also hated the press. On the other hand, Trump is suing those he deems malicious, like the Des Moines Register. These businesses are barely profitable and responding to such a lawsuit costs tons of money. In short, Trump, is an anti-institutionalist, and his base supports this. Going to war with institutions sets up counter-reactions, like a tight Fed, which then broadly destroy wealth or at a minimum spike volatility even such policies also create wealth in certain pockets. Tough world to navigate. Given that investors are extremely overweight stocks, I am cautious.