Substack Library

GlossaryUS, China–An Expensive Divorce

September 5, 2025The marketeers have taken over the country.

Norman Mailer, 2007

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

The US and China are in the midst of a slow, expensive divorce that cuts right through the corporate earnings of many major US companies, all $1.7 trillion of it. A case in point is Nvidia, the company that makes the railroad tracks for AI. More than 10% of their $165B of revenue comes from China, and they were told recently that they could export some chips to China if they paid the White House a 15% cut and used less powerful chips. To date, however, nothing more than a verbal agreement is in place, and as a result, billions of dollars of product is parked awaiting a formal agreement. A full divorce, which I suspect is coming, will be a drag on earnings in both countries.

Here is the context.

-

There are only two countries in the world with gigantic, internal, integrated markets—the US and China. Most countries are set up spoke and wheel. There is a capital city that controls administration, finance, culture, and industry and the periphery. Examples of this structure are Mexico, France, Russia, and South Korea. The US and China are different. They have vast internal markets with a common language, law, and currency and many cities with their own ecosystems. Beijing is to DC what Shanghai is to New York what maybe Nanjing or Tianjin is to Boston, except that everything is bigger, 22 million in Beijing versus 6.4 million in D.C. Given this, it is wildly profitable for companies in both places to get access to each other’s markets. The trouble is that the systems do not speak easily to each other.

-

China is ancient Confucian cultural values administrated with Soviet ideological software. Soviet software is also in place in Russia, North Korea, and Cuba. If you threaten the structure, the China leadership believes, you get bad outcomes, like the Cultural Revolution or Great Leap Forward or Tiananmen Square. Taiwan is sensitive because their evolution from authoritarianism to democracy challenges this premise.

-

America’s founding principles center on minimizing controls to the greatest extent possible. The result is that the US creates both the most profitable companies in the world and also the most dangerous cities in the developed world, a degree of both entrepreneurial success and violence unthinkable in China.

-

President Xi is a product of both the Cultural Revolution and watching the Soviet Union collapse. He is the most heavy-handed leader since Mao and believes the US is in terminal decline, of which Trump is a symptom. In the US, in part due to Xi’s truculent policy, there is now bi-partisan support to contain China.

-

Now put into the mix a new generation of technology (of which chips are the epicenter) that will guide the missiles and anti-missile missiles that each country is aiming at each other and the fact that clearly the speed of compute is a matter of life and death, as we can see in Ukraine. Each country wants the upper hand. The US currently has it, but this can shift fast, thus the controls on Nvidia.

-

Not only Nvidia, but many other American companies like Apple, Corning, Applied Materials, Thermo Fisher, Tesla, and Texas Instruments have significant exposure to China. Similarly, Lenovo, Shein, and Temu have significant exposure to the US.

-

As a result, one needs to handicap the revenue of any company that derives a significant source of revenue from China. Whatever you expected them to earn, cut it down by a lot. China is likely trying to wait Trump out, though both leaders may seek to extend their terms, prolonging the conflict.

-

Earlier this week, Xi, Putin, and Kim Jong Un celebrated a victory over Japan that the US, particularly General Stilwell, helped to engineer. Xi is openly supporting Russia in their war against Ukraine, so the battle lines are drawn. Putin crossed the Rubicon in Ukraine, and so far corporations in both the US and China are betting that the US and China will not make the same mistake. That said, structurally the odds of conflict are high which, combined with huge increases in global defense spending tied to rapidly changing technology, is ominous.

When I first started traveling to Russia and China, the future was full of hope. Now that era is a distant memory. The ability to move one’s capital quickly from one region to another and into one asset from another is of the utmost importance.

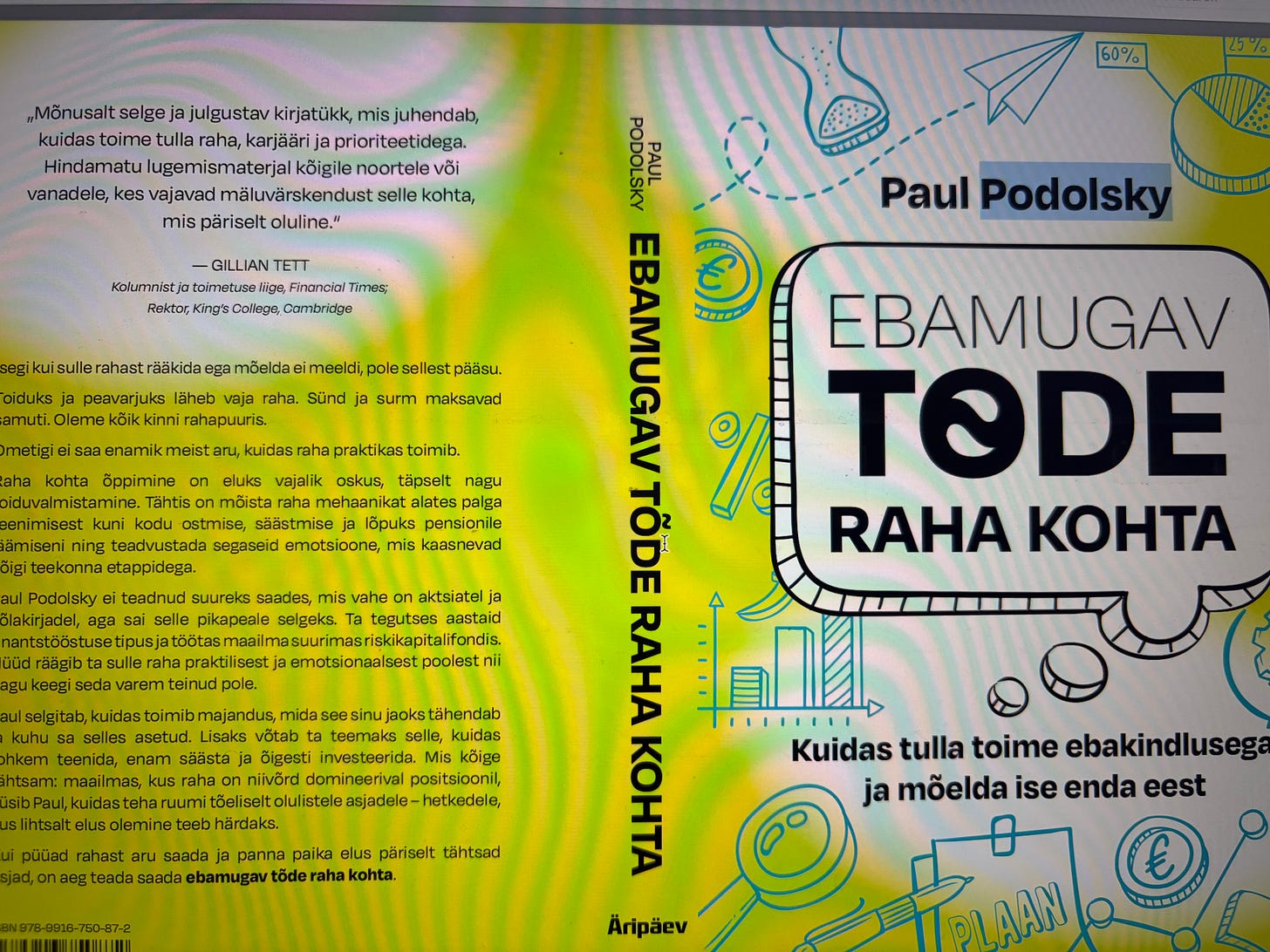

Now out in Korean, Italian, Estonian (below), Chinese and many other languages:

The Uncomfortable Truth About Money