Substack Library

GlossaryAI Will Change Jobs Before the Data Shows It

September 12, 2025THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

In hindsight, the course of progress toward ever faster, more efficient, and more useful machines seems effortless and inexorable.

Engines that Move, Nairn, 2002

Note to readers: Kate Capital is hiring. If you think you are a fit, email talent@katecapitalllc.com

Investing is imagining a picture of reality that has not yet occurred. The price of any asset rests on a distant envisaged future, which is why investors are like writers—they create imaginary worlds in their head and then wait for them to come into being. Today, we know growth and inflation are shifting due to AI—the argument is about how significant the shift is. My hunch is very significant and that the definitive numbers and proof will lag.

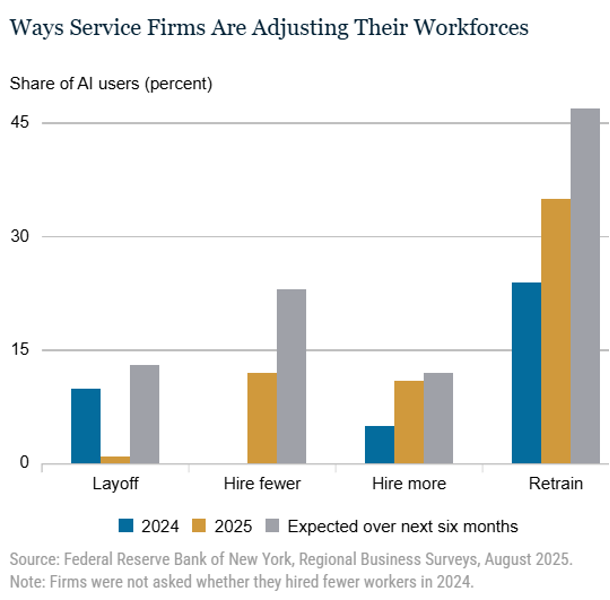

Just because something is difficult to measure, doesn’t mean it isn’t true. For instance, your sense of time is different if you are bored or excited, even if “measured” time is the same in both. Right now efforts by academic economists, central banks and brokers to measure how much AI is shifting demand for labor show a modest impact. The most recent report in this vein was one by the New York Federal Reserve. They surveyed firms in their district and found that AI is indeed impacting hiring, but the impact was as shown below, small.

I am skeptical for three reasons—capex spend, my own behavior and precedent.

1. Regarding capital expenditures, the current AI cap ex boom is on par with other great productivity capex spends that transformed economies. The proper way to put this into perspective is both as a percentage of GDP and duration. Getting precise numbers is difficult because some of the booms happened two centuries ago. That said, there have been five or six major waves of productivity—canals (1810s-1840s), railroads (mid-late 19th century), combustion/electrification (late 19th early 20th century), computers (mid-20th century) and Internet. Each of these booms created spending from 0.5% to 2% of GDP for each year it was in existence. Today’s AI spend ranks up there with the major tech transformations. That means we are on the cusp of unexpected outcomes. The internet boom did not envisage Waze and railroads did not envisage high-speed rail. Inventions will come on top of inventions. The motivation of the people spending money on each boom is to make money by changing behavior. This one is no different. It doesn’t pay off if people don’t change the way they work, which is already happening.

2. Regarding my own behavior, it’s a simple but true that a lot of good investment decisions can come from noting how we ourselves change. What I see in a short period of time is that I am using AI a lot. At Kate Capital, we are writing code using AI and the paragraph above on capex as a percent of GDP came was in part researched on AI. When I think of how many people we need to hire as Kate scales, the number is heavily influenced by how productive we are becoming. It’s also true that these AI tools deploy fast while past productivity booms deployed much more slowly.

3. Lastly, I compare this shift to others that were difficult to measure, like the 2008 credit crisis. I began feeling that something was off in 2004. That’s when I first shorted home builder stocks (oops). I also recall trying to convince investors that a housing bubble was building in 2006, when I wrote a presentation showing all the anecdotal information around such a risk. Investors were incredulous. The actual full evidence only appeared after the crash. Then we found out that Chinese recycling of their current account surplus led to surging dollar money market funding holdings that then got recycled into spread product that was supposedly highly rated but actually held lots of poor credit quality loans on homes people could not afford. I suspect five or so years from now we will see that the impact of AI on labor is already underway. The implication is that central banks will be slow to respond and both inflation and bond yields have further to fall.