Substack Library

GlossaryThe Wind Comes Out of the Sails

November 14, 2025We understood that life, even the worst parts of it, were a shifting mix of happiness and pain, good luck and bad, and that there was no reason to fear that bad luck was greater than good.

Varlam Shalamov, Kolyma Tales

NOT INVESTMENT ADVICE.

The wind is coming out of the sails because the Fed is about to make a mistake and the rate of change on AI is slowing while debt obligations to fund this innovation are rising. In more detail:

-

While it may seem odd that if the central bank raises or lowers interest rates by less than a percent it can determine the price of the $60 trillion U.S. stock market, and that these fluctuations can in turn impact global stock prices, that is indeed how the system works. The central bank is the heart and if it pumps less vigorously, the extremities get cold.

-

Bond traders are laser-focused on a financial instrument most have probably never heard of – SFRZ5. This is the futures contract whose price is largely determined by what the Fed does next month. Unusually, as stocks began to tumble, this contract priced in higher interest rates. Typically, it would be the opposite (lower stocks = lower interest rates). That is the smoking gun that tells you what is going on.

-

The Fed is divided because they don’t know whether the economy is strong or weak. The answer is that the economy tied to AI has been strong and the economy outside of AI is weak. The link between the two parts of the economy is the stock market and the labor market. Savers in the weak part of the economy can enjoy the bounty in the strong part via stock increases, but this technology is generally negative for wages. Now that the Fed has wavered, however, the stock market is wavering, meaning that the wealth effect might go into reverse at the same time the labor market is weakening.

-

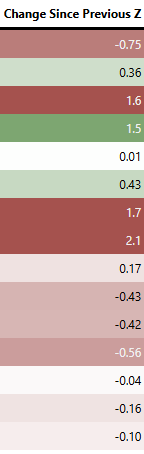

Because of the data blackout, Fed hawks and doves have little data to settle their disagreement. However, there is plenty of anecdotal evidence the labor market is weakening. Without going into exactly what we are tracking, below is the “z-score” of the alternative labor market data is. Each line is an individual set of data we track. Red is unemployment rising.

Whether these firings are due to AI or merely big companies cutting bloated workforces isn’t clear. Thursday, Verizon announced it was firing 15,000 people, this following big firings from Amazon, UPS, and others.

-

How far can this go? Further, is my answer, but not much further. The way I arrive at this is by looking at individual stocks, backing out the price at which they look like a good deal and then layering on a chart of the S&P 500. The issue isn’t all stocks, it’s the most high-flying stocks, “neo-clouds” like Nebius, which have fallen about 40%. They probably have further to go.

-

Nebius is an interesting case study. Nebius gives companies the tools to build their own AI platforms. This year, they have lost $450 million and have about $4.5 billion of debt. Of course, this business is just getting going, and the guy who runs it, Arkady Volozh, is a renowned Russian entrepreneur who co-founded Yandex, Russia’s Google. Investors are trying to agree on what the right price is for this business and that all depends on distant estimates of AI use cases, thus the swings in price.

Regarding AI momentum, while it is difficult to be precise because of how capex announcements are made, based on my calculations there was about $125 billion of new capital expenditures in 2025 and the new capex in 2026 will be far less. Economic growth is a change concept so this is actually slower capex going forward.

-

More ideologically extreme politicians on both right and left are struggling. In the U.S., the impregnability of White House policy is ebbing. They did poorly in recent elections, the tariffs are likely to be deemed illegal, and they are now being forced to walk them back because food inflation is rising in exactly the way text book economics predicted. Bitcoin, the emblem of MAGA, is below $100k. In the U.K., a country with no meaningful AI productivity play, the government is trying to plug a 5% budget deficit and placate bond vigilantes without meaningfully cutting back on social spending. The core issue is that neither the left nor the right has a coherent plan to address the underlying issue—tech disruption.

-

If you strip away the AI hype, the year has been muted. U.S. bonds rose about 2.5% (yields fell modestly) and an equally weighted mix of stocks is up about 7%. Outside of that, we saw a speculative pop that is now getting unwound. The fundamental cash flows of many companies are pretty good and unemployment is only rising gradually, so there are limits to the shakeout both in the U.S. and globally. The next shoe to drop is the resumption of labor market data. If the data is weak, the Fed hawks will cave. If the tariffs are walked back further, long-term US bond yields could once again become vulnerable.