Substack Library

GlossaryLetter from Sao Paulo

January 16, 2026One morning, while I was strolling in the garden, an idea appeared on the trapeze I have inside my head.

— Joaquim Maria Machado de Assis, The Posthumous Memoirs of Brás Cubas, 1881

NOT INVESTMENT ADVICE

In the morning, the sky is a tropical pewter-purple. By evening the humidity swirls and the clouds open up, rivers pour down the steep streets of São Paulo. The city is the hub of Brazil’s 200+ million population, a population spread over a territory larger than the continental US. Every country is an unstable jumble of opposing forces; Brazil’s core tension is around debt, interest, and redistribution.

While the governments of the US, France, Japan, and others are overspending, Brazil is in a league of its own. It is running an 8.5% budget deficit when unemployment is low. Each year government debt as a percentage of GDP ticks higher. The deficit is tied to years of pork-barrel politics and low productivity. Perhaps 70% of Brazilian adults get some sort of transfer payment.

Despite this largesse, Brazil’s Gini coefficient (a measure of income inequality) is the second worst among the G-20 countries. Moreover, the drinking water is not potable, the streets are rife with petty crime, and public schools are held in low regard. To be sure, São Paulo’s per capita murder rate is similar to New York. Still, the crime grates. I asked one Brazilian here why he prefers to live in the US. “I like to be able to walk my dog at night.” Women take off their jewelry when they leave the office.

Transfers to most and inflation adjustments on pensions are expensive. Brazil’s “primary” budget deficit—meaning the deficit not including the gigantic interest rate payments—is negative. To keep the bond market from imploding, the central bank has lifted interest rates to a cool 15%. The Fed’s 3.5%/3.75% rate looks tame by comparison. The central bank gained independence in 2021, an independence that is handy to keep this policy in place.

As a result of these high rates, locals with wealth are compounding at 15%. Real interest rates are less than 2% in the US and more than 7% here. But everyone knows this is not sustainable. Eventually, either the bond market blows up or policy shifts.

Elections

Policy is overseen by an octogenarian political Houdini, Luiz Inácio Lula da Silva. Lula is in his third term, after taking a break in prison following his conviction, later overturned, for “passive corruption” or accepting a beachfront apartment from a construction company. (Compared to accepting a plane from Qatar, the apartment seems almost frugal.)

While Lula lacks a college degree, his political instincts are uncanny. He pivots toward pragmatism when needed. Seemingly a friend of the late Hugo Chávez in Venezuela and Putin, I am told he privately sides with Ukraine. He is “non-aligned” the way India’s Modi is non-aligned and has fomented a strong trading relationship with China and stood up to US tariffs, perhaps sensing high imported food prices would bring the US to heel.

Still, the monied class here is terrified of a fourth term, with many predicting a sharp decline in the Brazilian real if Lula wins. Betting markets modestly favor Lula in the October 2026 election, in what would be his final term. His political Darth Vader, Jair Bolsonaro, is serving a 27-year jail term for attempting to undermine the results of the last election, where Lula unseated him. Bolsonaro was accused, along with military generals, of plotting to murder Lula.

In Brazil, the Supreme Court has more power than the US Supreme Court and instigated the investigation of Bolsonaro. From prison, Bolsonaro has nominated his son Flávio to oppose Lula. Flávio is seen to be lacking the charisma of his father. The educated long for Tarcísio de Freitas, the governor of São Paulo, to run as a centrist. Their hope is that a rightward political shift, along the lines of what has happened in Argentina and Chile, could trigger a boom.

The Potential Boom

As I traversed the city, marveling at the thick Figueira trees, the mechanics of a boom were not hard to imagine. The Brazilian real is cheap, interest rates are high, and the total size of the Brazilian stock market is a fraction of Nvidia’s market capitalization. If the government were to swing a little right, or even if Lula wins and he is not as extreme as feared, a modest fiscal tightening would lead to a plunge in interest rates and that cash would then find its way into an equity market.

The locals are pessimistic. They did, however, acknowledge that all asset values are relative. To get the real to collapse, locals will have to sell their own assets and buy the US. I noted that the US needs to suck $1 trillion of savings from the rest of the world to keep the dollar stable and the dollar has dribbled lower since US policies became so erratic.

Changing Fortunes

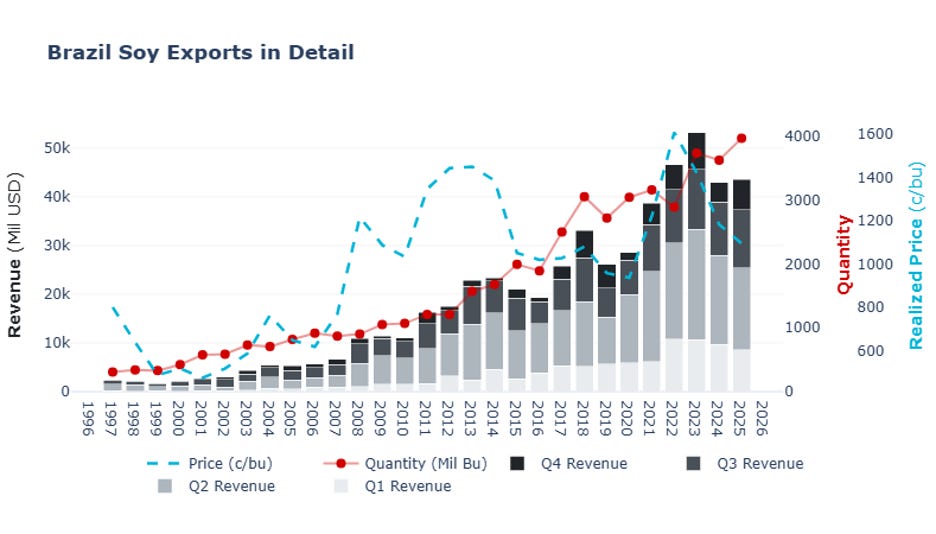

Brazil is one of the few places in the world with excess agricultural land, enough to feed its people and export to others.

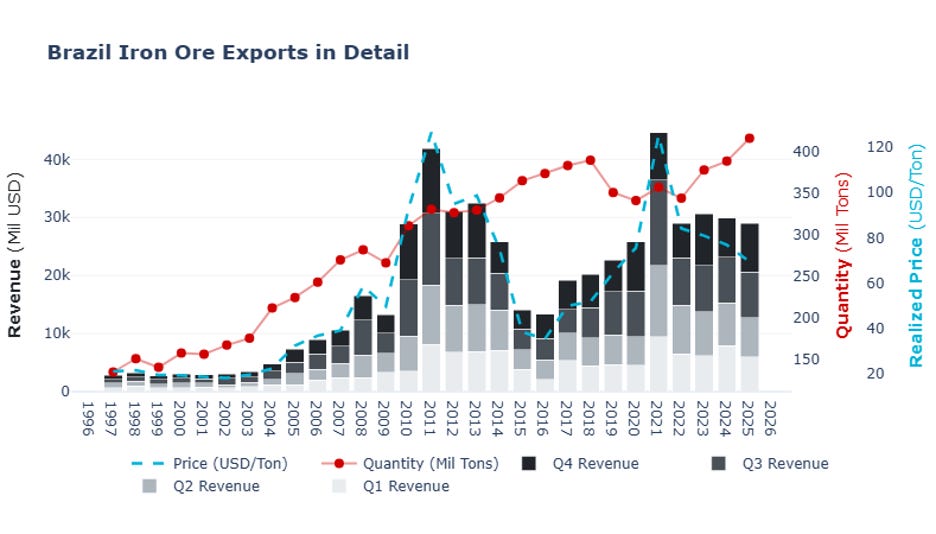

They also have rich deposits of iron ore and are less ideologically combative than the US or Australia, which is why Brazil runs a $30 billion trade surplus with China. “Brazil has water and China does not,” is how one person described it to me.

The question is if a country like Brazil can benefit from the productivity boom afoot in other countries. Beyond cutting the budget deficit, a productivity lift would help balance the books. Certainly, the agricultural sector here is highly productive. Some of the biggest companies in Brazil, like Vale or NuBank, have the raw ingredients for using AI to boost productivity and widen margins.

Every country has its special thing. In Cuba, it is the music; in Russia, it is the ballet and literature; in the US, it is the tech and military. In Brazil, beyond obviously talented soccer players and a rich geography, I’d describe their special thing as a certain gentleness. Conversations that would last 15 minutes in the US last an hour or more here. Even their drift to authoritarianism was more gentle.

Chile, Argentina, and Brazil all fell under military dictatorships. Brazil’s ended relatively recently, in 1985. But in Argentina and Chile, thousands of people were killed by their dictators in awful ways. But Brazil’s military dictatorship killed just a few hundred people, which, while horrific, is a milder version of awful. Locals here are once again fearing the worst but, compared to what I’m seeing elsewhere, I came out optimistic, even if the election does create some volatility. Own some now and buy more later.