Substack Library

GlossaryAnxious Mr. Market

October 16, 2025THIS IS NOT INVESTMENT ADVICE

Rare earths, defaults, ICE fast roping onto buildings…it’s easy to get keyed up. Stepping back, the big picture is a deflationary productivity shock wending its way through global markets.

In more detail.

-

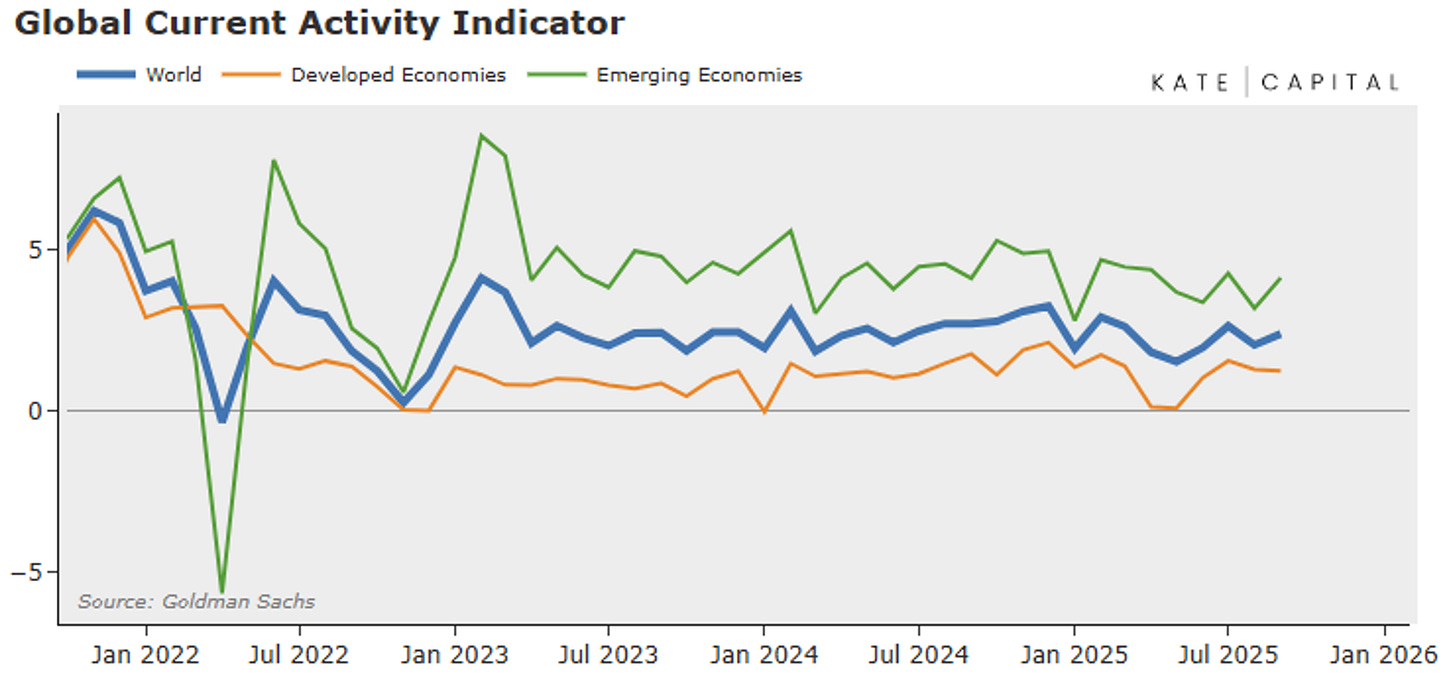

The global economy is growing. It isn’t a boom. It isn’t a bust, but steady growth. The AI upswing is being offset by a non-AI downswing. Parts of the economy, like real estate, are particularly weak in the US and China, for instance.

-

Global inflation is falling. In the US, wage growth is slowing and oil prices are down 16%. Inflation is labor and oil. I show global inflation below.

-

When you can replace people with machines, it’s hard for there to be much inflation. China recently introduced a robotic cotton picker.

-

Labor markets have had downward surprises. We have seen this in Australia, UK, US and Mexico. This is making it hard for new graduates in particular to find work. Yes, tariffs are inflationary, but the net impact of AI and tariffs is what matters.

-

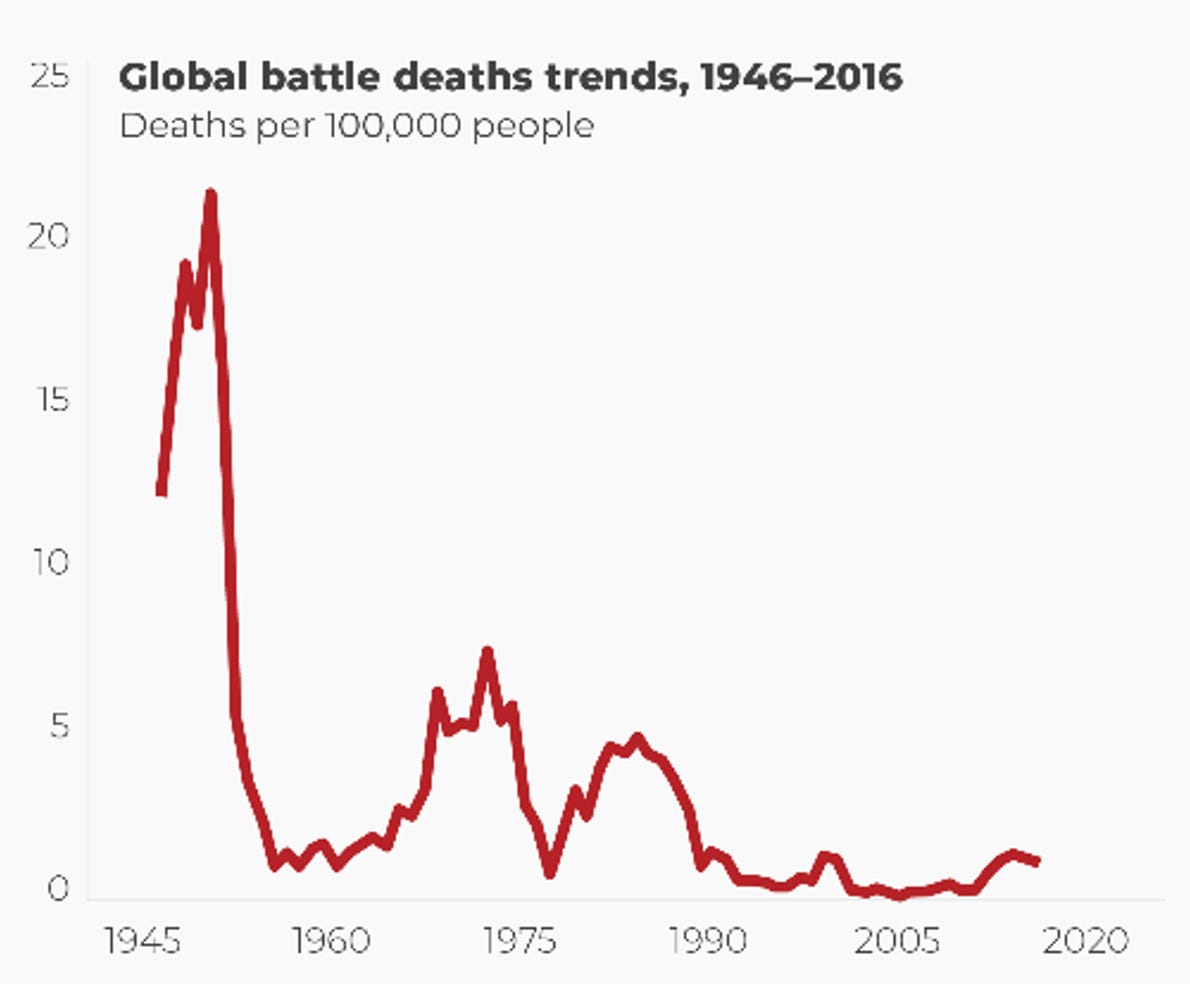

The threat of conflict is high, but the percentage of the global population dying in armed conflict is low, notwithstanding the violence each day on the news. The big lesson is don’t give up your nukes. Ukraine did and it is a blood bath. Putin is a gambler, but Xi is realpolitik; he won’t make a rash move if he believes his opponent has leverage.

Source: Peace Research Institute, SDG16 Data Initiative

Regarding rare earths, the US doesn’t import many of them and the military has about a 10-year supply. The US sold its rare earth refining capability to China about 40 years ago because it is not a great business. Now some of that business has moved to Pakistan and Myanmar. It will take about 5 years for the US to build its own refining capability, a lot less if it is deemed a national emergency. China is using this moment of relative strength to drive the US to the negotiating table, but it is a negotiation, not a new hot war.

-

While stock markets everywhere in the world are expensive, in many parts of the world, their supply is declining. Said differently, the amount of IPOs (new shares) and share issuance is small in comparison to the amount of buybacks. With profits strong and supply decreasing, the direction is likely up.

-

While fiscal deficits are large in many parts of the world, interest rates are high enough that private sector demand for credit is modest. Below I show US (gray) and Europe. This is not credit-led growth.

-

If the tariffs are not deemed illegal, the US may join other governments (UK, France) in taking modest steps to narrow their big deficits. In Japan, because the rate of nominal growth is higher than the interest rate, government debt as a percent of GDP is declining.

-

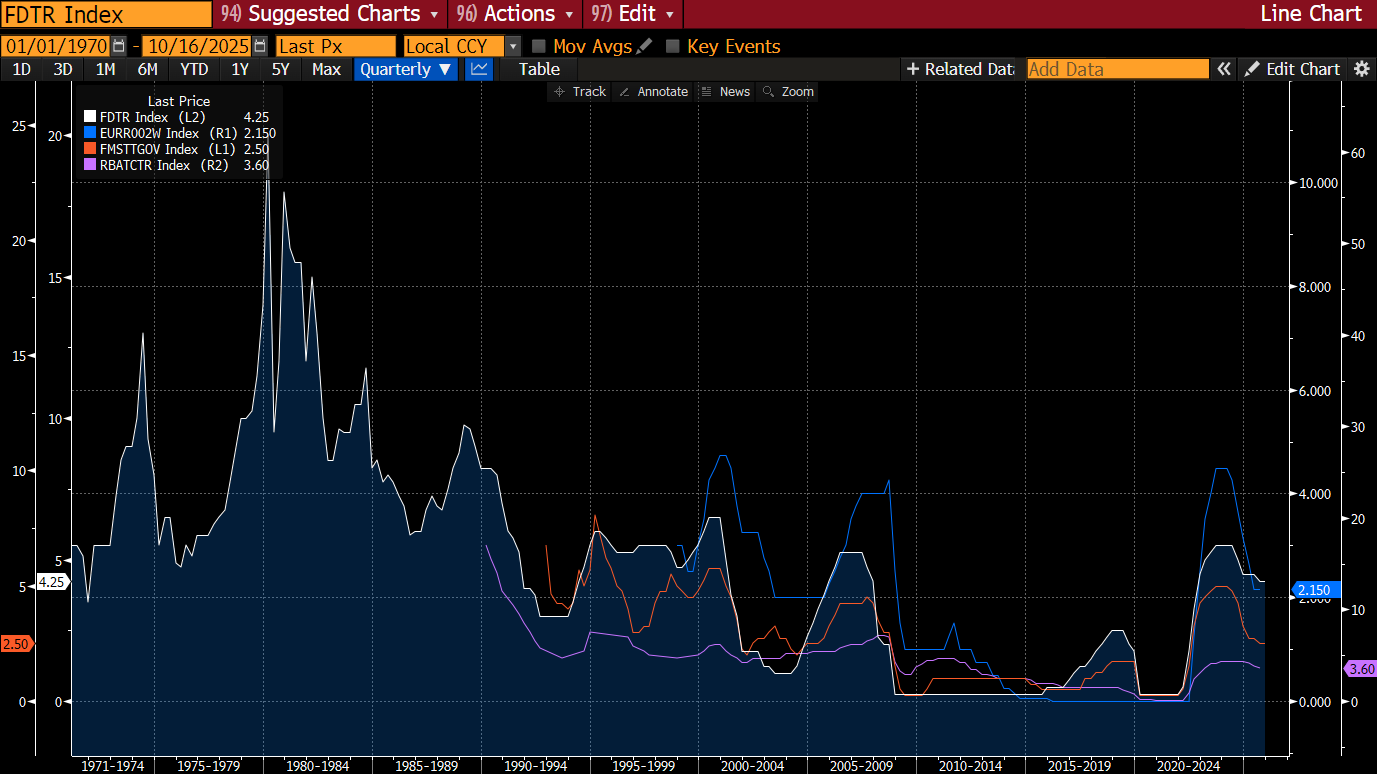

Central banks, which had been selling bonds, will soon stop. They are also easing, as you can see below.

-

Anxiety is high. You can both feel it and measure it. Since last Friday, the VIX volatility index is up about 30%. But when I step back and think about the fundamentals, they look pretty good, as long as your job is not in the AI cross hairs.

My books:

About being a parent: Raising a Thief

About work: The Uncomfortable Truth About Money

A fictional book about global financial war: Master, Minion