Substack Library

GlossaryBalance of Power

January 30, 2026“US Trade Policy remains unpredictable… a loss of independence of the Fed would affect us all.”

Bank of Canada Governor Tiff Macklem, 28 September

To understand what just happened with Warsh being selected as chief of the Fed requires imagining the power dynamic at play, even if we can’t obtain all the corroborating evidence. On the face of it, Warsh makes no sense. His claim to fame is opposing Ben Bernanke and advocating for tight money during the global financial crisis—a decision that would have been a bad policy error. Not the type of guy Trump would want running things, it would seem.

So I look elsewhere for an explanation. To run the Fed, a nominee must get approved by the Senate Banking Committee, chaired by Republican Tim Scott. Scott’s policy preferences are traditionally conservative. He has been explicit that the Fed should remain independent. Is it possible that the Senate let the White House know that if they preferred a “hard money” candidate? Perhaps. Then Warsh’s tight-money credentials go from a seeming weakness to a strength. That’s the most plausible explanation I have for Warsh, and it sets up the possibility that if the economy weakens in the second half of the year—which I expect—and Warsh is at the helm, the Fed will be late and wrong. This would tend to hurt stocks, help the dollar, and be bullish for the long end.

If the Senate did push back on the White House, quietly, the break comes at a critical time—investors are applying a higher risk premium to US assets. Once this risk premium kicks in, it can trigger self-reinforcing actions that exacerbate the initial move, boosting the US cost of capital.

In more detail:

-

Copper prices moved 10% on the day Thursday morning. This is the physics of liquidity—the prices of things that are rising a lot are not as liquid as the prices of things that are losing relative value, so the shift in one relative to the other is disproportionate.

-

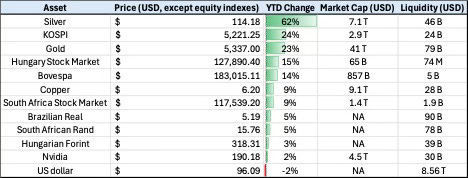

The table below is a rough, back-of-the-envelope calculation of what is going on. The table is a list of assets that macro managers are involved in that might be off your radar, depending on where you live: Korean and Hungarian stocks, the South African Rand… you probably know Nvidia.

As I have noted previously, the Brazilian stock market has a fraction of the liquidity of Nvidia. Silver and gold have more liquidity, but that is because prices have skyrocketed recently (prices are as of Thursday). While both Nvidia and the Hungarian forint are up this year, the forint is up more because 9 million people live in Hungary and 330 million people live in the US, and if a small amount of capital leaks out of Nvidia, it is a lot of capital for Hungary to absorb. Prices adjust. Similarly, while gold was up a cool 24% this month before plunging around 10%, there isn’t much of it to trade. Most of it is held in vaults.

-

The risk premium hinges on Fed independence and rule of law. The conversation shifted from “will the Fed cut/hike” to “will the Fed remain independent.” Optimists note that the Supreme Court didn’t seem receptive to administration arguments to strip the Fed of independence and that whoever is Fed chairman will need to corral votes and does not have autocratic control. But that misses the point. The odds of the Fed losing independence have gone from zero 24 months ago to perhaps 10% or 20%. As Macklem said in further remarks, it is such a big change it’s difficult to comprehend what it would look like. Some people aren’t waiting to find out.

-

Recognize that when the dollar falls and a foreign currency rises, it is a deflationary shock for the foreign country. The cost of all their imports begins to decline. The more open to trade an economy is, the bigger the impact. This means that foreign central banks will be easing policy, which would then boost their asset prices, attracting more inflows because a foreign investor gets rising assets and a rising currency. For US investors invested unhedged in Japanese stocks, they are up 7.8% this year versus about 1.5% in the US. How will Warsh act once he gets power? We will find out soon enough.