Substack Library

GlossaryPopulist Leaders = Slower Growth

August 7, 2025THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Absent repressive violence (North Korea), political power is contingent on rising living standards. Modern wealth creation hinges on technological disruption, which improves everyone’s life (consumer surplus) but concentrates wealth. Many simultaneously can’t put down their phones and disdain the owners of the technology that makes the phone possible, angry over their collossal wealth. The obvious political solution—raising taxes while reducing government graft—doesn’t work well because capital and labor are mobile.

But the popular angst is genuine. Opportunistic political leaders tap into this and run on some version of “Make (insert country) Great Again” but then implement policies that are intended to address the angst but instead hurt growth, sometimes disasterously. That’s what’s happening right now—an aggressive tax hike is bringing growth, absent AI, to a standstill. That’s why the NASDAQ is up this year and the Russell 2000 is down. Central banks are slow to realize what’s about to happen and will be forced to act quite soon.

Below are examples that might seem disparate but are all linked.

In Russia, Putin rose to power on the “make Russia great again” formula, or MRGA, thus bringing back the red Soviet stars on top of the Kremlin and other genuflections to Sovietism. To really make Russia great, he needed to apply his formidable energies to eliminating corruption and allowing Russia’s economy to diversify beyond oil to tech. Russia has fantastic tech entrepreneurs. Google, Telegram, Yandex, Nebius, and other star companies were all created by Russians…who fled to the west or whose parents fled to the west. Rule of law would have exposed Putin’s own corruption. As living standards failed to rise in Russia’s vast hinterlands, Putin pivoted to nationalism, culminating in the disastrous war in Ukraine. When I tried to pull up a chart to see how Russian stocks were doing, I got this message:

In China, Xi rose to power on a similar message—”Chinese Dream of the Great Rejuvenation of the Chinese Nation,” or MCGA. He has brought back Mao-era propaganda and spread Xi Jinping thought. China is, like the US, a country with a vast internal market and population nodes around many large cities, a structural advantage. It also has hardworking, smart entrepreneurs that run companies like Alibaba, founded by Jack Ma, the Chinese Amazon, with some fintech thrown in. China should be wealthy. But to truly MCGA, Xi would have had to allow the Jack Mas to reach Zuckerberg and Bezos-like wealth and also support China’s own legal reforms, which would have meant exposing the Party’s corruption. Instead, he stripped the entrepreneurs of power. Stocks are unchanged for over a decade and Alibaba is about 60% below the peaks. Chinese growth has slowed and deflation set in.

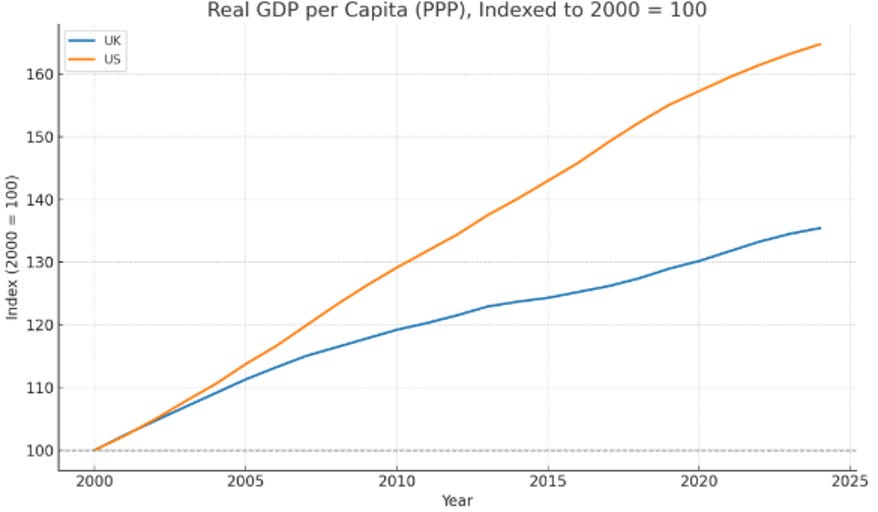

The UK version of MUKGA was first “A Better Future” under the right-wing David Cameron, which resulted in the disastrous political miscalculation of proposing a vote he lost on Brexit. The current left-wing PM, Starmer, has overseen an increase in taxes on the wealthy, in particular by eliminating favorable tax treatment for non-UK citizens, which has resulted in wealthy people deserting the UK. Like I said, capital is mobile. Brexit weakened the UK economy; the current policy is shrinking the tax base. Strict budget rules now suggest further tax increases can kick in if the economy weakens further. UK GDP/capita has lagged and the pound looks vulnerable.

Source: ChatGPT

In the US, MAGA equals tax hikes on US importers, businesses, and consumers. This will remove money from the economy that would otherwise have been spent. There has been so much back and forth on the tariffs (10%…no 30%…no 15%) that it’s easy to miss the basic truth—fiscal tightening. There are signs this is leading to a rapid slowing of activity. I suspect major central banks are on the verge of panic. Not so long ago, the story was of a soft landing and inflation gradually getting back to trend. Now US job growth has rapidly slowed, asset price appreciation outside of tech stocks has ground to a halt and even reversed, and borrowing is weak. Foreign economic indicators are softening. Central banks are out of step with forward conditions and will be forced to ease. While tech stocks are up 9% the Russell 2000 index of small-cap stocks is down 1%, as shown below. Should the erosion of US institutional norms continue, capital flight will likely pick up.

Now out in Korean, Italian, Estonian, Chinese and many other languages:

The Uncomfortable Truth About Money