Substack Library

GlossaryShifting Balance of Power

July 18, 2025What is necessary?—To wrestle with your problem until its emotional discomfort is clearly conceived in an intellectual form—and then act accordingly.

Dag Hammarskjold, 1964

THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

To navigate the investment environment, it’s necessary to anticipate not only growth, inflation and monetary policy but also geopolitics. Germany and Japan are catching my eye.

Geopolitics must be considered relative to:

-

AI boosting output per worker and causing a squeeze in everything required to build AI, from switches to cooling.

-

Tariffs removing money from the U.S. economy. (Every time you see the word “tariff” think, “tax hike.”)

-

A pull forward of spending by everyone hit by tariffs, which will soon end.

-

High government deficits.

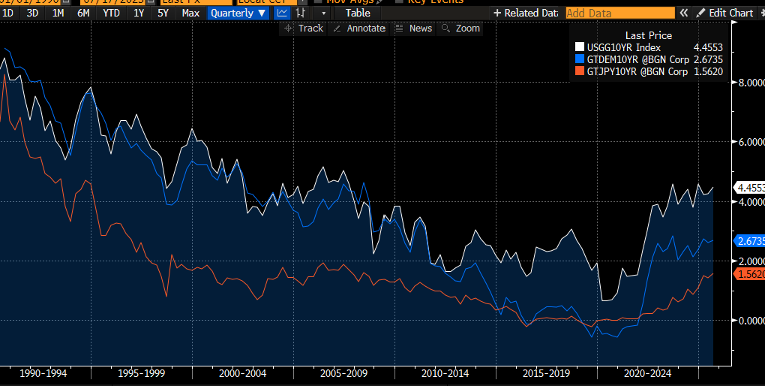

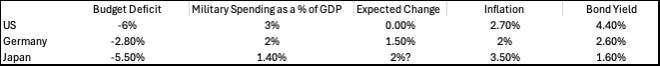

Regarding geopolitics, this week Trump flipped his view on the flow of US arms to Ukraine while insisting that Europe will pay for them. Germany, in particular, is aggressively boosting defense spending. Japan is also being requested to re-arm. More defense spending equals more borrowing. This is occurring at a time when Japanese inflation is substantially higher than that in the U.S., and both Japanese and German bond yields are lower than the U.S., as you can see below.

At present, the inflation-adjusted return on lending money to the Japanese government is negative, and quite modest in Germany compared to the U.S. If U.S. tariff revenue rises while German and Japanese borrowing increases, the gap between their relative bond yields might narrow.

The catalyst that put this all in motion is, of course, Ukraine—today’s Spanish Civil War.

Ukraine

I recall staring at the screen when Putin invaded Ukraine. I was in an apartment in Cyprus, overlooking a wide swath of the Mediterranean. A G20 member invading a neighbor to slaughter its people and seize territory obliterated the post–Cold War peace dividend in one day.

Up to that point, I thought of Putin as a modern Stalin. Unlike Stalin, Putin killed people selectively and publicly to instill fear and seek revenge, rather than resorting to mass liquidations. All that changed with Ukraine.

If Russia is successful in Ukraine, perhaps Moldova or Latvia are next. NATO is already being tested. As in the Spanish Civil War, the world’s ideological splits are evident. China supports Russia. Europe is pro-Ukraine, as are Japan, Canada, and Australia. India is non-aligned. The U.S.’s allegiances are less unclear.

Germany and Japan

In February, Vice President Vance traveled to Europe with a simple message—the U.S. no longer has your back. He said Europe was a “vassal” of the U.S. and that its defense structure was a tax on Americans.

In March, German Chancellor Friedrich Merz responded: “In view of the threat to our freedom and peace on our continent, the mantra for our defense has to be, ‘whatever it takes.’” The quote is a reference to former ECB Chief Mario Draghi, who once vowed to do “whatever it takes” to avert a financial crisis.

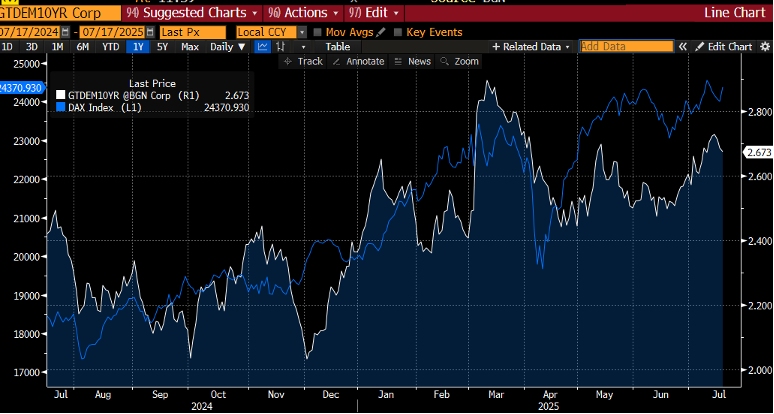

This translates into a 10% of GDP boost in German defense spending—something like 500 billion euros. Immediately following the announcement, bond yields rose almost 50 basis points and have since settled slightly above where they were before. The DAX, Germany’s stock market, is up 22% this year, versus 7% for the S&P 500.

Yet the “real,” or inflation-adjusted, yield on German bonds remains below 1%, which I show below (purple) versus the nominal bond yield (white). If German bond yields move higher, this would likely draw capital into Europe.

Japan is also a “vassal” in Vance’s terminology and is now being pressured to increase defense spending and accept higher tariffs. There are reports that Japan has been asked to boost defense spending to 5% of GDP. An election this weekend will offer insight into Japan’s political direction, but further fiscal easing features in the slogans of opposition leaders trying to soothe voters battered by a weak yen and high inflation. Below I show Japanese inflation (blue) and the bond yields (white). Inflation is well above the bond yield.

The global architecture is being redrawn. As spending and bond yields rise abroad, and the U.S. continues to signal that the next Fed chief will not be independent, a gradual outflow of capital seems likely as do higher foreign bond yields. An increasingly militarized world with charismatic leaders also has an eerie resemblance to the 1930s—Spanish Civil War and all.

Now out in Korean, Italian, Estonian, Chinese and many other languages:

The Uncomfortable Truth About Money