Substack Library

GlossaryThe Great Debate

December 12, 2025NOT INVESTMENT ADVICE.

Investing is like prosecuting a case—there is evidence, both to acquit and convict; you need to render a verdict. The case being tried on Wall Street and the Fed is on the current productivity shift.

Is AI an inflationary, debt-fueled boom?

Or is AI:

a) Already powerful enough to clip jobs by the tens of thousands at the direction of CEOs eager to meet elevated earnings expectations?

b) Reached the point where the additional spend is impairing balance sheets?

c) Far from the point where AI can be broadly impactful?

This debate is overlaid on a political debate.

Are tariffs, zero immigration and other White House policies leading to a boom or a slowing?

My bias is that disinflationary forces are ascendant, and the White House policies have obscured this fact because the erratic application of tariffs boosts uncertainty and, temporarily, prices.

As always, I will be guided by the evidence and adjust accordingly.

In more detail.

-

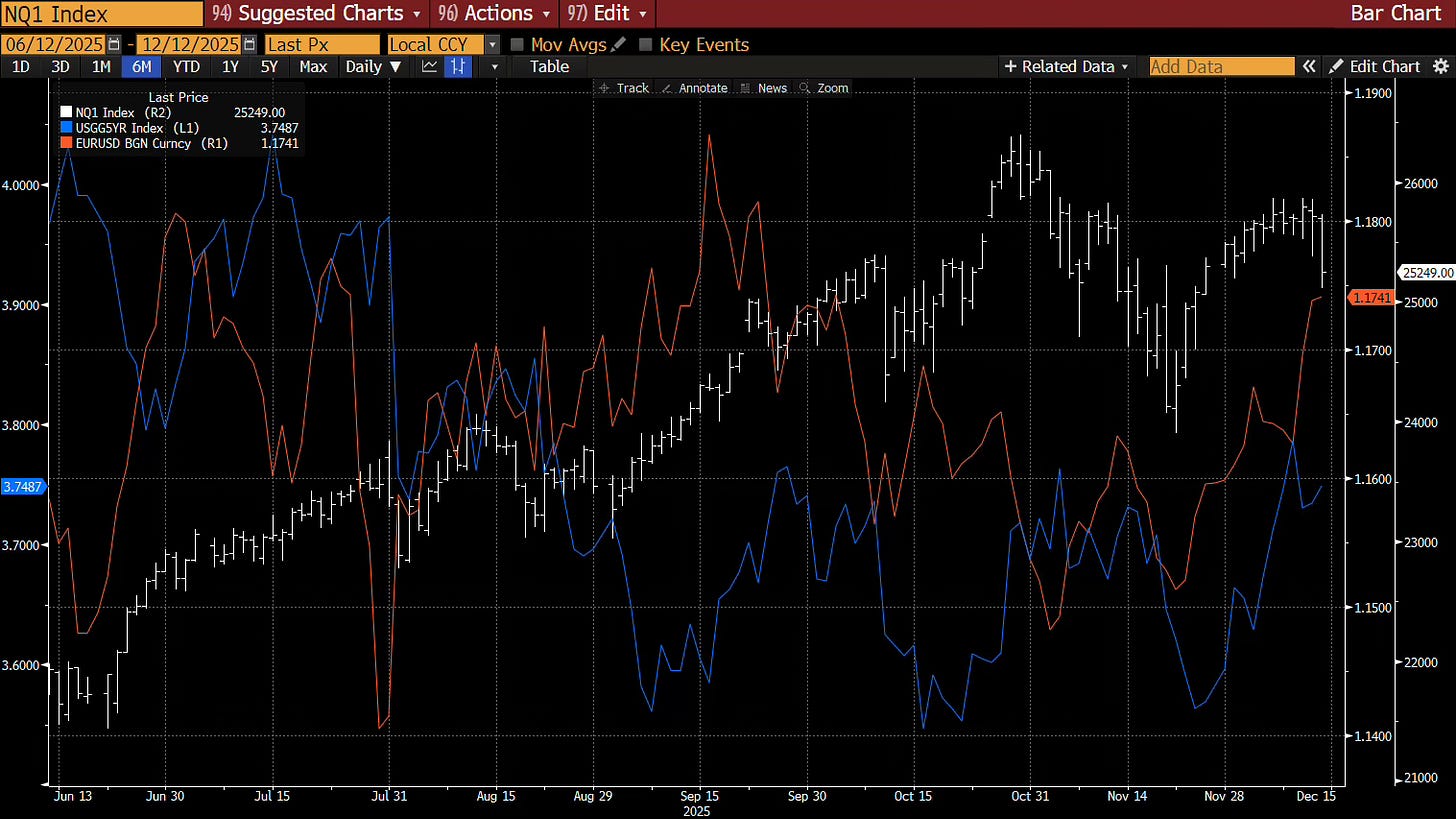

Markets are stuck in ranges. Below I show on one chart the Nasdaq, euro vs. USD and 5-year US government bond yields. The euro has not moved since June; 5-year bond yields are unchanged since August and the Nasdaq has not moved since September. Why? Because investors can’t fully commit to a direction unless they know the outcome of the debate. Is the Fed done cutting rates (because of the AI boom) or on the cusp of doing more (because of the deflation and slowing capex)?

-

Job growth is weak. The most important development in the debate this week was three sentences uttered Wednesday by Fed chief Powell. “Unemployment is now up 3/10 from June through September. Payroll jobs averaging 40,000 per month since April. We think there’s an overstatement in these numbers by about 60,000. So that would be negative 20,000 per month.” Said differently, based on the Fed’s analysis, job growth is contracting. This is important but complicated. The labor force growth is slowing because immigration has slowed to very little (roughly 25% of what it was) and the tariffs are contractionary. In any event, job growth is weak, so the hundreds of billions of capex spent this year does not seem to be net job positive.

-

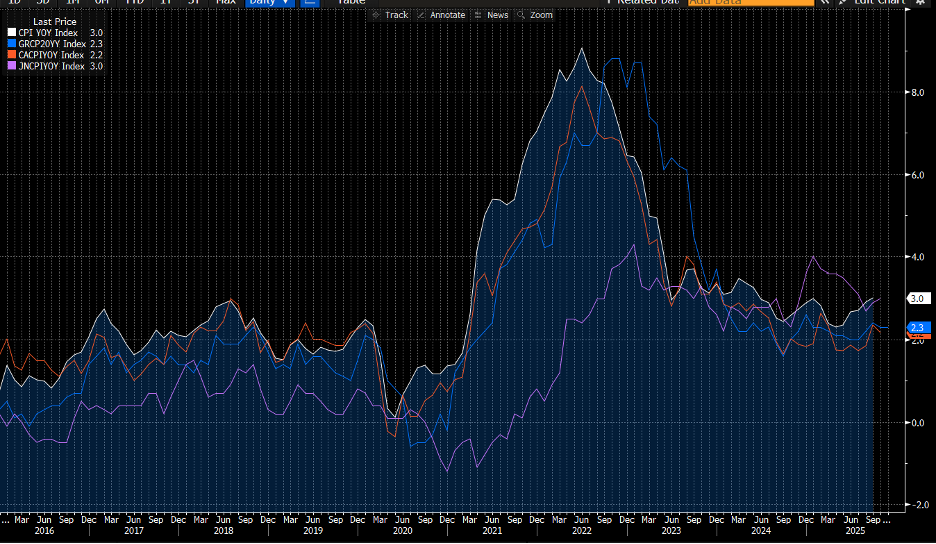

Inflation is off the boil. Inflation was around 2% in most of the world, leapt to 6%-8% and has since declined. It is at target in many countries. In the US it is above target because of tariffs. Central banks have cut rates, including the Fed, but rates are nowhere near where they were before the inflation began so the response to cuts so far is relatively muted. Inflationary pressures are weak if the labor market is weak. Energy prices are also weak. Below I show inflation in the US, Canada, Japan and Germany.

-

The big capex spenders are being punished. Today stocks are getting whacked due to a report that Oracle will be delaying some spending. I noted last week that Meta cut some of its capex. Below I show a chart of Meta, Oracle and CoreWeave versus Apple. The market is not rewarding the big capex spenders because investors are not confident the spend is justified. That does not mean the market is right but it does point to a disincentive to spend. Apple (the purple line), which is not a big capex spender, is being rewarded. Incentives matter. Moreover, the big AI spenders are at war with one another. Google is trying to undermine Nvidia, Nvidia is trying to support Tesla/X, Meta and OpenAI, China is trying to undermine America and America China. While there will be some winners, it’s also highly likely that there are spectacular losers. The message for many investors could well be “who knows who will win.”

The counter argument to the above is that this AI spending is transformative enough that the money is going to be spent no matter what and this will create a significant lift to the economy. AI acolytes suggest that the point at which the AI can meaningfully replace a personal assistant that books airplane tickets, balances books, closes sales deals, etc. is close at hand. (That said, I’ve been tracking how long it has taken to build technology that can answer a telephone call from a customer, and so far it is forty years and still counting). If AI is on the cusp of a new breakthrough, then that recognition combined with fiscal stimulus tied to defense and we could be on the verge of a mini-boom. I am watching each piece of data and adjusting my expected odds in real time but as I said at the outset, I’m inclined to believe growth will ebb.

The next piece of the puzzle is US employment out next week.