Substack Library

GlossaryThe US China Tech War

October 10, 2025“It does require a bit of thought as to how we can adapt.”

BOE Governor Andrew Bailey, on visiting empty town centers in rural England

THIS IS NOT INVESTMENT ADVICE.

China and the US have irreconcilable political systems and are fighting over technology that determines who will have military supremacy. The stakes for markets are high.

In more detail.

-

About 36 months ago, ChatGPT appeared. ChatGPT brought AI from the lab to our desktop. It didn’t require a fancy degree to see that this thing could do a lot. The “wow” factor continues as new features are rolled out. I recall a story my grandfather (born 1902) told me about demonstrating a short-wave radio to his father. “You are tricking me, someone is up on the roof,” my great-grandfather said to my grandfather. We are at that stage.

-

Earlier that same year, Russia invaded Ukraine. This was the moment ideological differences descended into violence.

-

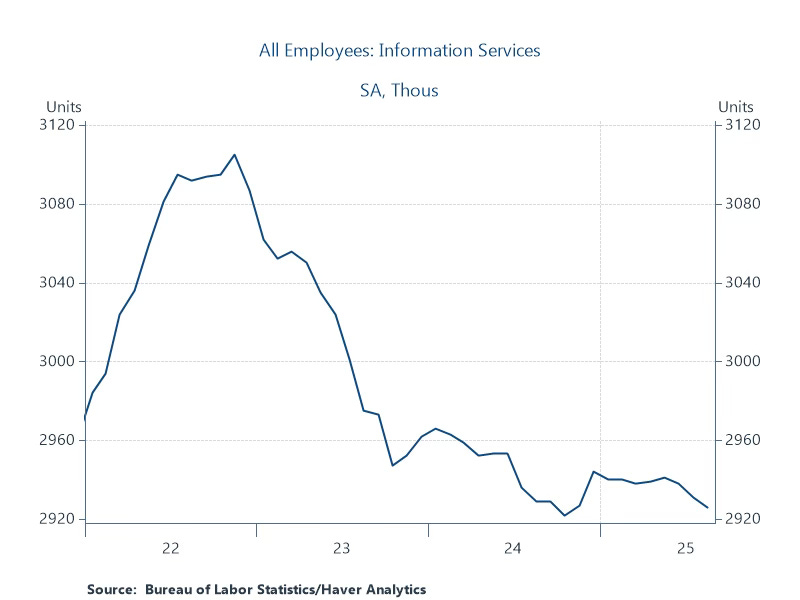

After getting 1 million users in its first week, ChatGPT now has 700 million daily users, who mostly pay … nothing. China is also investing heavily in AI. The first-order impact was rising unemployment of US tech workers, as shown below. China is also struggling with high unemployment among recent college graduates. AI weakens demand for many types of labor.

-

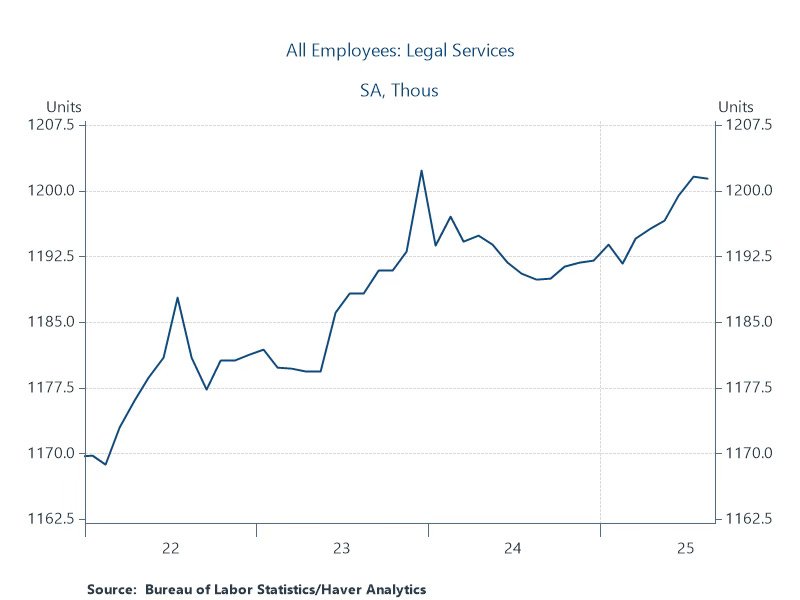

While AI can in theory replace lawyers and radiologists just as quickly, this hasn’t happened. Employment for lawyers, as you can see below, continues to grow. Maybe this is due to regulatory issues, or because law firms restructure more slowly. Put differently, huge shifts in labor are ahead of us.

-

China and the US both see this technology as a fight for their autonomy, which means compromise is hard. The US has cutting-edge technology, China has rare earths and other assets, and they each use these clubs to hurt each other.

-

Today’s wave of technology is also likely the root cause of political instability, evident in the US, UK, France, Japan, and many other countries. Large swathes of the population feel understandable unease at what comes next and take out their anxiety at the polls. This technology also drives our social media, which contributes to political instability.

-

Russia stumbled in Ukraine in part because drones reconfigured warfare. The country with the fastest AI chips wins the automated warfare fight. Now Ukraine has begun to strike deep into Russia, showing how powerful mastering technology can be. This is an ancient story in warfare.

-

Bondholders look at the political dysfunction this technology seems to produce and get worried. Every national leader wants two things at once—cutting-edge technology and good jobs. AI is one, not the other.

-

Equity holders believed a) the people making the technology would make a lot of money (NVIDIA) and b) the people using the technology would save a lot of money (Fortune 500), which helps explain why large-cap stocks are up around 16% globally. But that thesis stumbles if the supply chains fundamentally break down. That is not priced.

-

If OpenAI can generate $100 billion in profits, it all works. The Mag7 companies earn about $150 billion a quarter now, but that is after years of work and eliminating many competitors. So the numbers are not crazy, just ambitious. Total US corporate revenue (public and private) is around $40 trillion, with profits of about $4 trillion. When I do the math, I think the odds are tilted toward the optimists, which is bullish for stocks, bonds, and probably the dollar, absent a US-China tech war.

-

What neither the optimists nor the pessimists have priced is the possibility that China directly confronts the US. From China’s perspective, that’s what the US is doing. If that happens, by, for instance, truly limiting rare earths exports, the AI boom runs into an unexpected challenge, the US economy slows, and the Fed is less worried about sticky inflation and more about sharply rising unemployment. Hopefully, the US and China are merely negotiating. But the risk is the negotiations are protracted and damaging. A warning sign was the massive run up in gold. Was this China stockpiling ahead of a battle? Maybe.