Substack Library

GlossaryTouching the Limits

April 25, 2025THIS IS NOT INVESTMENT ADVICE. INVESTING IS RISKY AND OFTEN PAINFUL. DO YOUR OWN RESEARCH.

Today I want to distinguish what we know and what we don’t know.

What We Know

-

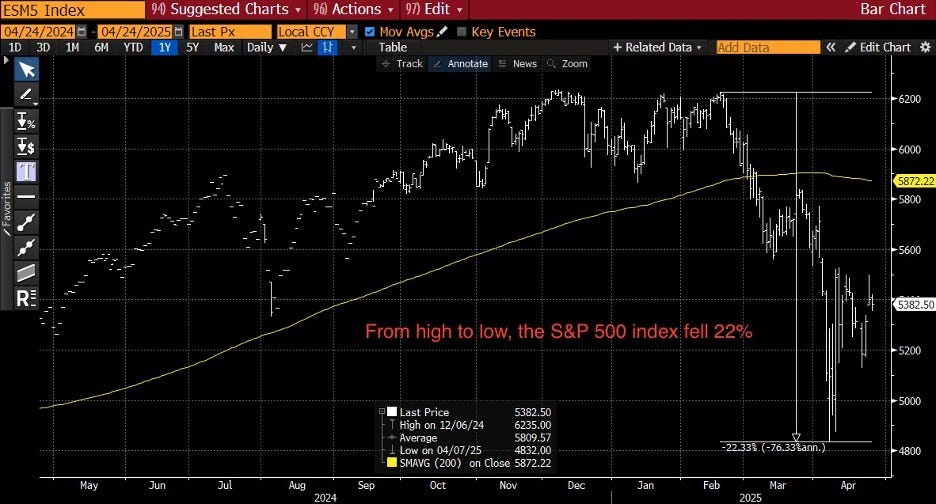

Twice close to the edge. A new US Administration took over about 100 days ago and implemented radical policies that brought us close to the edge of financial collapse on both 4/7 and this past Monday, then abruptly walked these policies back. By “close to the edge,” I mean the White House had lawyers looking at their ability to fire the Fed Chair this week. Stocks were down, from top to bottom, 22% in the tariff sell-off. Lower equities = lower growth and confidence (via the wealth effect). But a stock bounce will immediately soften that blow. The stock market did what Congress and the courts failed to do: constrain the President. Recent financial policy was similar to the Jan. 6 incident—it brought us close to the edge but not over it. The more policy goes to the edge, the higher the odds we do finally go over it.

-

Weighing odds. The odds of firing the Fed Chair were less than 50%, but the downside was a crash—say, another 20% drop in stocks, the dollar, and bonds simultaneously. The upside is what we’ve seen: an 8% stock rally off Monday’s lows.

-

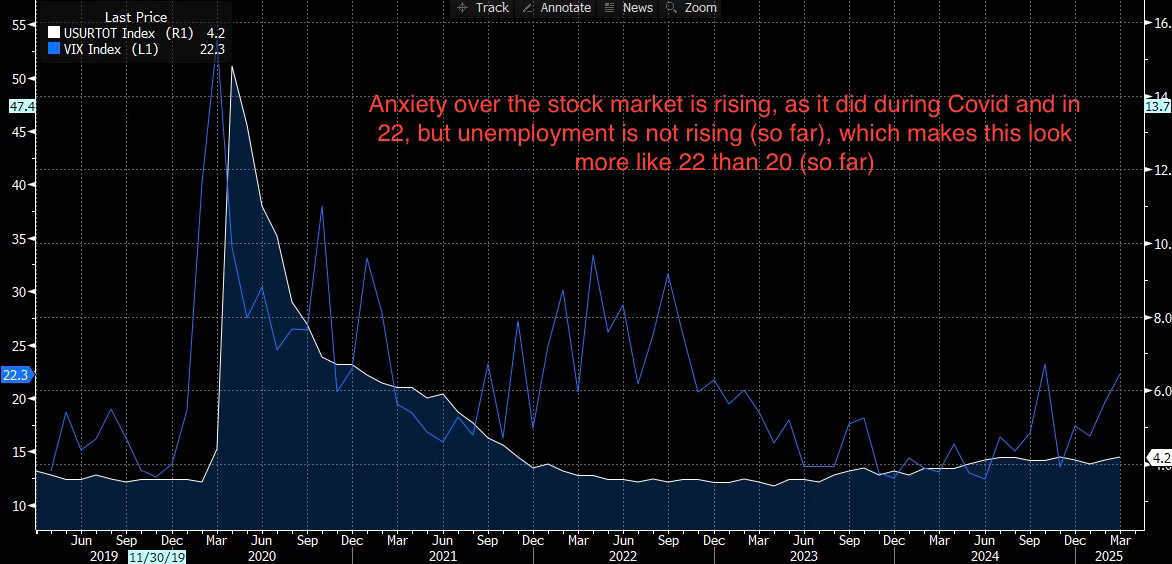

Hard data healthy. Some MAGA optimists were dismayed by how extreme the policies have been. Some MAGA skeptics were surprised by how fast the Administration pivoted away from their initial policies. We’ve had a big reaction in the asset markets, as shown above, but no measurable reaction in the real economy. Volatility on some days was as high as in 2008. Below, I show the VIX (volatility index) in blue, which measures how worried investors are about the stock market, versus the unemployment rate, which remains low. In 2020 (COVID), the rise in VIX was closely followed by rising unemployment, but in 2022 it wasn’t. This time, the volatility is caused by the whims of a single person, as opposed to a lethal virus—meaning it is much easier to bring volatility down. Policy just needs to be less extreme.

-

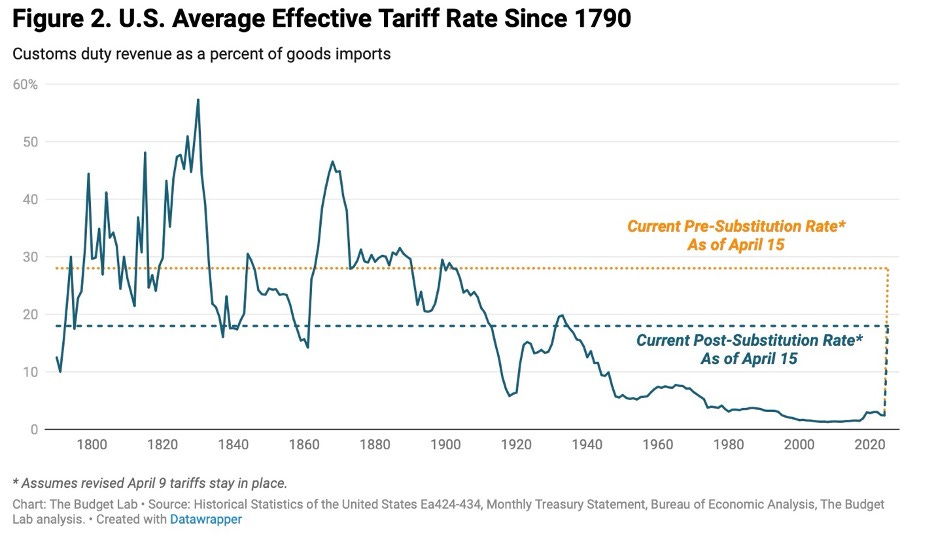

Tariffs are high. How high is complex due to all the shifts, delays, and exceptions, but this chart from the Yale Budget Lab is a good place to start. This changes by the day. As I write this, there is a report that the Chinese have a list of U.S. exemptions, meaning they are shifting tactics even though they appear not to be. High tariffs and erratic policy will likely impair capital spending and hiring, which should slow global growth, as will deportations and slower immigration. Backing off extreme tariffs will lower inflation risks, giving the Fed more room to cut, which supports asset prices. The talk today is of trucking and freight companies seeing an abrupt slowing in activity, which, given the pattern, suggests yet another shift in White House tactics is coming.

-

Households buy the dip. The decline in stock prices was (according to dealers) driven by hedge funds that were max long in February. These hedge funds have now unwound their positions—some are short, many are neutral. They are losing money on these short positions as U.S. households come in and buy the dip again and again. This has driven U.S. equity valuations back up to their pre-drop peaks, which were in the 9th decile. So we’re back to where we were—U.S. stocks are expensive, only now we have a (somewhat) better idea of what is coming: tariffs and slower growth.

-

AI powers on. AI stocks, once the apple of Wall Street’s eye, have fallen a lot—many are down 20% to 40% this year and back to where they were a year ago. Yet, many continue to make solid profits. If the White House narrows the scope of the trade war, hedge funds may well lengthen back into these names.

-

Palace infighting and polls. White House policy is split. This is how Trump 1.0 worked, and it’s how 2.0 works. The Treasury Secretary wants to implement the President’s agenda in a way that doesn’t upend markets. The “Counselor” (Navarro) is a true believer—enough of one that he went to prison for contempt of Congress and certainly doesn’t care if stocks fall. Polls show tariffs are unpopular, and the President’s popularity is declining—a fact that has angered Trump enough that he tweets about it as fake news. Those polls, plus the market action, led to the retreat. Bessent is now speaking a lot, and Navarro has gone radio silent.

What We Don’t Know

-

Future policy. People with personalities like the President crave attention and drama above all, so something must feed that need. It might not be economic policy, however—it could be the culture war, which is more popular with his base than tariffs. This means tariffs could be walked back, or not. If you find yourself exhausted from tracking the twists and turns, that’s by design. CEOs, trade partners, and foreign investors are exhausted too, which is why the economy and foreign inflows to the U.S. will likely slow.

-

Employment is everything. Typically, soft data like sentiment (which is currently terrible) leads to weak hard data like unemployment. However, to date, there is no hard evidence the economy is weakening. Short-term measures of unemployment look healthy. The next key event is the release of April employment data on May 2. Weakness would shift the dialogue. On the other hand, if the U.S. economy actually survives this mismanagement, expectations of Fed cuts will evaporate—leading to a potential violent reversal in bonds.

-

Budget deficit. The new budget will be expansionary, but whether that occurs in a boom or bust matters. If it’s in a bust, the 7% budget deficit could widen to 10% as payroll taxes fall and unemployment insurance rises. If it’s a boom, the deficit could stay around where it is. In either case, the U.S. will issue a lot of bonds that the rest of the world needs to buy at a time when US policy is, as I noted, erratic. If foreigners merely buy less US assets (rather than sell them) the dollar goes down.